Introduction

Value in biotech

Money is essentially social credit. Your income depends on the social value of your work, not the personal value. – Steve Pavlina

“Money is social credit”. It also applies to corporations. A biotech company’s income depends on the social value of its work (drug/device), not the shareholders’ value.

How does a biotech company create social value? By creating innovative products that help the public maintain and improve their health with accurate, science-based evidence. To summarize, such product must achieve one of the following advantage against current standard of care:

- More effective

- no drug

- more effective drug

- population

- Safer

- less mortality

- less SAE/AE

- population

- More affordable

- More convenient (comfortable)

Only first three are FDA’s responsibility as quoted below. The fourth “convenience” factor’s social value is inevitable. Just compare an injectable drug and oral drugs.

FDA is also responsible for advancing the public health by helping to speed innovations that make medicines more effective, safer, and more affordable… FDA: What We Do

With these four value factors in mind, we investors want to find and help biotech companies that generate social value by investing in them. As the company creates social value, we get social credit - money - along the way. It is a “win-win-win” situation, for the company, the investor and a better world.

What we learned so far includes two sides of the struggle for approval: FDA and Companies.

FDA regulatory statistics

Note: FDA faces tremendous pressure from sponsors, patients and public to bring safe and effective new drugs to the market faster. It is expected that FDA may loosen its strict control on certain indications with huge unmet medical needs and approve more drugs. These indications include orphan diseases, female libido and other areas that no drug is currently available.

As strict as FDA is, the regulatory statistics discussed below may change as FDA evolves. Its implication for investment decision will also be affected. Nonetheless, studying what happened before can provide insights for the future.

Success rates of drug development

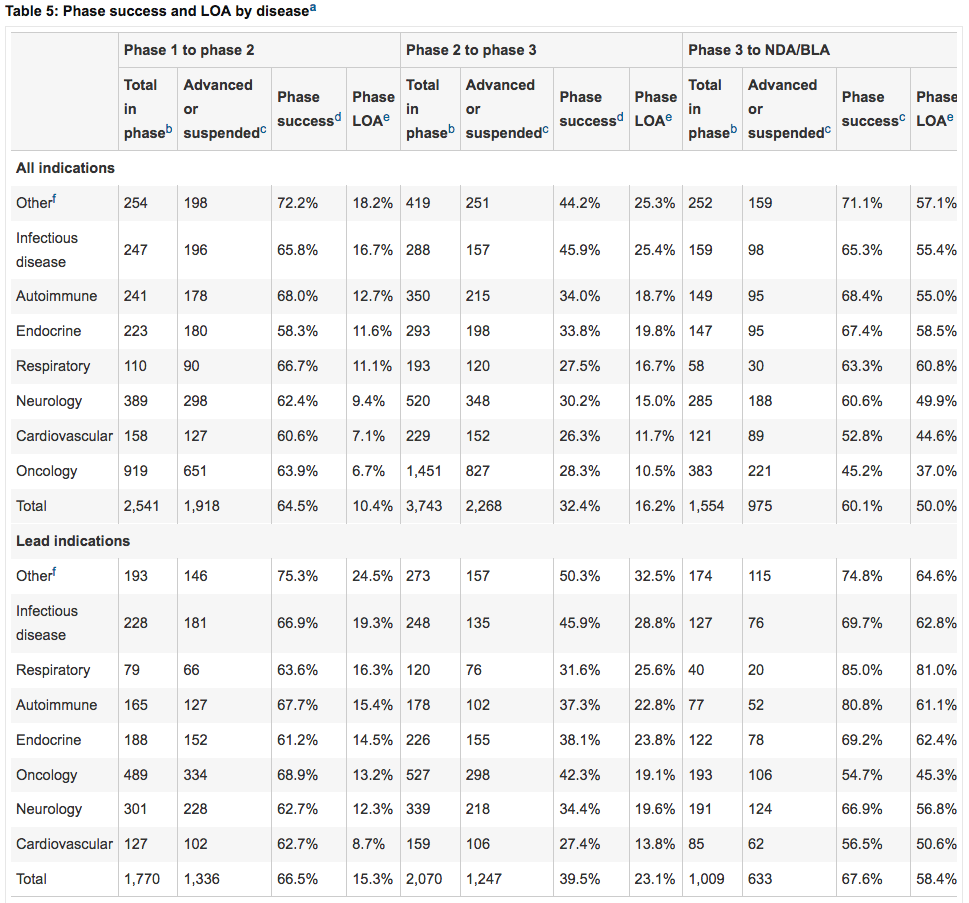

Clinical development success rates for investigational drugs. Hay et al. 2014 Nature Biotech.

It generally took 20 years from scientific discovery to clinical and commercial adoption. – David Brindley. Nature June 16th, 2016 A decade of iPS cells.

Each phase have different goals:

… after years of research and hundreds of millions of dollars, the majority of drugs that never get to market fail because they do not show efficacy in the disease they were intended for. That’s a staggering fact, and it has a number of important implications. One of the implications is that our animal models for toxicity are pretty good (after all, the Phase II failures passed Phase I, which looked for toxicity), but our animal and cell-culture models for disease are very poor for many diseases. In other words, we lack good models that would allow us to validate targets and fail compounds much earlier in the drug-development pipeline, when the cost would be much lower. Using Phase II Failures BY Gregory A. Petsko

Various types of diseases have different success rates at each phase due to exactly the same reason:

Reasons of CRL from Sun Yu

Since FDA is always involved in drug trials and NDA filings, why there are so many cases of CRLs, especially demanding more data or trials? Why does FDA allow the NDA filing in the first place?

A: 1) pre-NDA not everything, not thorough

2) Advisory panel opinion

3) Adverse event detail

Likelihood of Approval

Great Expectations: CRLs and Approvals of FDA Ruling for Investors

Statistics provides the following factors implies the chances of a NDA/BLA approval:

- Base on Nature Biotechnology 2014 paper

This paper gives comprehensive statistics on approval rates. It considers indication, round of review, company size, leading, NME. orphan designation etc. -

First submission

As shown in figure below, first submission on average only has 57% chance of approval, while 88% eventually gets approved. Discussed below in “CRL is not the end”. -

First NDA

Inexperienced companies usually do not handle their first NDAs very well. -

Device and drug combination

Will be reviewed by two main branches of FDA: CDER (Center for Drug Evaluation and Research) CDRH (Center for Devices and Radiological Health). The chance of something goes wrong is higher when you involve more parites. For example, human factors in device operation. -

Indication

For example, vaccines are 100% approved once they reach NDA stage.Vaccines are 100% approved once they reach NDA stage.

- Efficacy

If the efficacy is suboptimal, FDA may CRL it the first time. Depending on how much unmet medical need is there, there may be second chance (Case: CHTP; ACAD) -

Safety

If there is SAEs (severe adverse events) in the clinical trial, even if it may not directed connected to candidate drug, the chance of CRL and additional trial is high. But as “Safety issue is less an issue” pointed out, it can be solved eventually and present high investment potential. -

Company size and experience

Unlike giant pharmaceuticals, small companies are usually inexperienced and lack of resource or connection or relationship when dealing with FDA. -

Breakthrough/Orphan drug Designation

Not really help.

CRL is not the end

Rejection is not the end of the world. Approval does not always come first cycle.

As shown in figure below, first submission on average only has 57% chance of approval, while 88% eventually gets approved. This is true especially in Neurology indications. It suggests that first submission are usually not perfect and FDA can always find some flaws. But eventually it will be solved. This “CRL then approval” type of cases have huge investment potential.

Clinical development success rates for investigational drugs. Hay et al. 2014 Nature Biotech.

Safety issue is less an issue.

Not all rejection is the same.

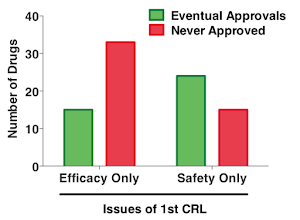

Another paper in 2014 studied the reasons of CRLs:

Scientific and Regulatory Reasons for Delay and Denial of FDA Approval of Initial Applications for New Drugs, 2000-2012

Some highlights:

- CRL results in a median delay to approval of 435 days

- Common reasons: 1) dose selection 2) improper end point choices 3) inconsistent results 4) poor efficacy

- never approved vs. delayed approved: 1) safety issues similar 2) efficacy deficiency much more frequent (76.3% vs 39.4%).

When issuing a CRL, FDA usually cites four types of reasons:

- Efficacy deficiencies

- population

- intervention

- end point

- study conduct

- study outcome

- Safety deficiencies

- severe adverse events

- safety study not done

- untested population

- CMC: Chemistry, manufacturing, and controls

- Labeling

Sack et al. studied 151 cases of first-cycle review failures during 2000-2012. 71 of them are eventually approved, while 80 are never approved. The authors correlated their first-cycle deficiencies to their eventual outcome. They found those four types of reasons are not equal. Some are easier to solve than the others.

The most counter-intuitive finding is that safety issue is actually easier to solve than efficacy issue (see figure below). My interpretation is that safety issues can be mitigated by proper labeling, dose adjustment, population restriction, etc. But when a drug is not effective, it is hard to improve and the benefit to patients is questionable.

For detailed data statistics, please refer to the paper.

Scientific and Regulatory Reasons for CRL Sacks et al. 2014 JAMA

Late Stage Clinical Companies

All That Glitters Is Not Gold. How to Screen for Successful Ones?

Market conditions affects expectation. I try to separate this factor.

- Buyout candidates:

CHTP, CBST, DRTX, ITMN. Approve then buyout. Good investment -

Phoenix reborn: CHTP, DVAX, ACAD. near death with CRL or Trial issue, then come back strong. Great investment.

-

Ignored gems: ANAC, EGRX. Great investment

-

Mature companies: GILD, CELG. Stock price inline with big market (IBB). Might as well buy IBB

-

Priced-in ones: MNKD. Approve then no change, or go down slightly. Usually approval is expected. Pipeline weakness?

-

Trash or Hype: DCTH, AEZS. CRL then down to penny.

How to conduct research

“Just do enough”

Researchers don’t need to find every detail:

- Unnecessary: As a group, insights mostly come from discussion. That’s the strength of our club.

- Researchers burn out, never want to do it again, or leave the club.

Four Steps:

Candidates -> Disease -> Product -> Financial

Pick Candidates

In this framework, we exclude mature big companies. You would rather buy IBB index.

We don’t have to fix on one certain strategy for candidate picking. We can have a variety of ways looking at catalyst pending:

- CRLed

- PDUFA pending

- NDA pending

PDUFA is a nice pre-screening that we can select candidates companies that survived Phase I.II.III. It is also a deadline around which we can plan our meetings. - PIII / PII: “second Phase 3 trial initiated”

- Starting from disease/industry

Each partner can exercise his/her own expertise, preference, and creativity.

Temporary Fail: CRLs, trial failure, miss endpoint etc. (aka. Phoenix Reborn)

情怀: built on one key patent, compound, chemical, device, procedure, or platform. A company that has vision, mission and focus. (Buyouts and ignored gems). – Hao X.

Unbiased screening: Even a bad company is Ok. It’s also learning experience. Of coz, we have to screen out obviously bad candidates. – Bo Z.

Behind the success of many companies is a focused mission: Gilead focuses on antiviral drugs with its nucleotide analogs. Celgene focused on HIV and hematology. Cubist was antibiotics.

If you are

Focus

Expertise: deepest, best, unique, only in the world

One drug candidate may fail. But the unique experience is always going to be valuable. It will only get deeper with your persistence.

Persistence:

- when is right?

- Academia is diff than industry. Arthur Krieg CpG group

People

Weeds

Discontinued Given up

Side project not aligned with mission

No mission

No innovation

Rose

Mission focus

No/low debt

Partnership w. Big pharma Commercial (CHTP, ACRX) or RnD (DVAX, OPK)

Doctor/patient feedback (CHTP, ACRX)

Law suit against innovation (EGRX)

Grant from government (DOD)

Innovation

“All have been invented”. Many text book knowledge had become driven force into fruit.

Disease

Focus: Long-term Economics; Understandable

- Current market size

- Standard of care: unmet medical needs

- Demographic Trend

Product

Focus: Long-term Economics; Understandable

- How to address unmet medical needs

- Mechanism of action

- Innovation and patents

- Risk and benefit profile

- safety and efficacy

- cost

- Competitive landscape

- existing SOC

- other companies’ pipeline

- generics

- FDA history

- Likelihood of approval

Should refer to above “Likelihood of approval” to assess.

Financial

Note: Only financial analysis is covered here. For investment decision, please refer to PSIC Investment Chapter.

Focus: A Sensible Price Tag

- Revenue estimates

- Other products and pipeline

- DCFF Model Valuation (Note: we found this sophisticated model unnecessary)

- Earnings estimates

- Price Multiple Valuation

- Financial statements

- Debt / Cash position: Burn rate

- Technical Analysis

- price volume pattern

- Gap

- Base, top, trend

- Recent Offering

Big institutional investors, who need to buy big chunk, can only buy at often inflated offering price. As small investors, we should buy cheaper than that, at least half the price.

After valuation

Case and examples

Ideas for future

How do you see it differently than consensus?

Suggestions from Bihua Chen (CEO, Cormorant Asset Mgmt.):

At NDA stage, most stocks have priced in. We should look at drugs in Phase II/III:

- How strong is the trial results?

- How confident is the management?

- Are they realistic? Or dodging any warning sign?

- What questions are analysts asking? What do they care? How does management respond?

- Do we (PSIC) see anything different?

Read SEC filing (might be too much work). Listen to webcast. Bottom line:

For one ultimate scientific question about this drug, how do PSIC see it differently than consensus?

Materials compiled:

- My thoughts #done

- Zhechu’s thoughts

- Boston Reunion Presentation

- Media Kit

- Dandan Research Framework

- How to select candidate

- From regulatory to investment MW

- Project review

- Website pages and posts

- resources

- 2014.2015 letter

- case studies research

Decided not to include:

- 2013 letter value averaging