(My) brief history of Arbutus BioPharma

In the summer of 2014, everybody was impressed by the wild clinical and commercial success of Sovaldi, busy judging its high price tag, somewhat jealous about the 11.2B sale of Pharmasset, and admired that Gilead’s gamble finally paid off nicely. I, as a novice biotech investor, was looking for the next Pharmasset and a cure for myself, as an HBV carrier. I was excited to find that former Pharmasset team, after 2011 sale and one year transition in Gilead, had already founded a new company focusing on Hepatitis B Virus in 2012. They named it Oncore Biopharma, wishing to strike an encore after curing HCV.

It was still a private company at that time. Most news were about its stellar team, their new ambition, and deal after deal in which the company collected diverse HBV assets under its roof.

While I could not invest in a private company, I kept it on my radar.

After an intention to file IPO, Oncore Biopharma eventually became public with a merger with then transitioning Canadian biotech Tekmira. Tekmira rose to prime light in 2014 with its DOD contract in fighting Ebola crisis. With the crisis tapered down and failure of Tekmira’s drug candidate, Tekmira decided to combine with Oncore to create an HBV power house.

When I read the news, the newly combined company had a market cap of 1.1B with no drug in near sight, needed to raise cash, and had inflated book value of intangible assets and goodwill from acquisition. I didn’t know how to value it either. I decided to wait on the sideline.

Fast forward to late 2016, when my eyes set on the company again (now renamed to Arbutus BioPharma), ABUS had gone through a sharp decline after public offering, the Biotech 2015 correction and 2016 consolidation. It was then hovering around ~$4. The company had discontinued its TLR9 program and Cyclophilin inhibitor program. It also decided to delay its cccDNA sterilizer program. Intangible assets and goodwill were written down.

I acquired my initial position before the ARB-1467 first trial result release in September 2016. Share price continued to decline after that lukewarm result release. Then toward the end of year 2016, a major competitor Arrowhead scrapped its HBV program due to safety issues. Suddenly, ABUS became the only and most advanced candidate in HBV RNAi race. With second data release, ABUS began to stabilize. And when Alexion license deal broke news, ABUS finally broke out upwards.

That’s where we are now. Here I present my complete Buffett style investment thesis on ABUS.

Understandable first-class business

Hepatitis B is the most common serious liver infection in the world. It is caused by the hepatitis B virus that attacks and injures the liver. Two billion people (or 1 in 3) have been infected and more than 350 million people are living with a chronic hepatitis B infection, including about 2 million in the US. Hepatitis B is preventable by vaccine, is controllable by NUCs (nucleoside/nucleotide analogues) or Interferon.

However, the cure rate is very low. Once on NUCs, patient has to take the drugs for the rest of his life, otherwise dangerous relapse and drug resistant mutant virus would emerge.

HBV is hard to treat due to its many clever ways to evade our immune system. Its swamp of decoy viral antigen HBsAg exhausts and represses our immune system; its cccDNA structure persists in the nucleus. The consensus of field for an HBV cure is combination therapy. Arbutus strategy is very clear: get multiple assets for combination therapy under one roof.

“Owning all of our combination components enables rapid and effective evaluation of different mechanisms in-house.”

1. RNAi: presentation

2. Capsid: presentation

Arbutus also has a non-HBV asset: its LNP RNA delivery technology.

For more details, please refer to this Feb 2017 presentation from the Company.

Long-term enduring economics competitive advantages

Leader in RNAi/mRNA delivery

Despite that Arbutus has dominant IP portfolio in LNP technology. In recent years, it has fallen out of favor as newer GalNAc technologies advance. LNP has to be delivered by IV infusion, while GalNAc based ones can go by SubQ. Interestingly, by the end of 2016, as Arrowhead scrapped its HBV RNAi pipeline and Moderna struggled to get enough efficacy delivering its mysterious “revolutionary” mRNA therapeutics, Arbutus’s old LNP suddenly came back to life.

After all, it is the delivery technology used in the most clinically advanced RNAi drug candidate: Alnylam’s Patisiran. With phase III topline results due in mid-2017, Patisiran may as well be the first RNAi medicine that makes to the market.

Perhaps old, but tried and true, LNP found a new life in the burgeoning mRNA medicine.

… mRNA therapeutics, which can range in size from 2-kb mRNAs (~660 kDa) to 20-kb self-replicating RNAs (7,000 kDa), are highly charged and have no bioavailability. For systemic delivery of RNA molecules of this size and charge, the only avenue available to address the systemic delivery problem is via nanoparticles, primarily ionizable LNPs… – Nature Bitoech 2017 Overcoming cellular barriers for RNA therapeutics.

The article cited above is a good review of RNA delivery technologies. It is pretty pessimistic about LNP, particularly in RNAi delivery. It seems the field has long moved on to GalNAc and related new technologies.

However, as it stated, LNP is currently the only avenue available for bigger mRNA therapeutics.

After long frustration with Moderna, in March 2017, Alexion signed a single product license deal with Arbutus to use its LNP delivery technology in its mRNA drug candidate. With Alexion setting the bar, more deals will follow.

Read this poster to learn more about Arbutus LNP in mRNA therapeutics.

HBV assets: leader and partnership

While HBV field is getting crowded after the success of Sovaldi on HCV, the competitor landscape is actually not so complicated.

RNAi competitors:

Replicor: its NAP-based HBsAg inhibitor is Arbutus’s most serious competitor. Most recent conference presentation had shown amazing HBsAg repression, which was followed by HBsAb protection, while combined with NUC and IFN. It is very close to what Arbutus and rest of the field thrive to achieve. Unlike Arbutus, Replicor has no other assets.

Alnylam: ALN-HBV. HBV is not their focus. And they only have RNAi, no combinatorial assets.

Arrowhead: ARC-520, ARC-521, used to be the leaders, now flushed down the toilet. Arrowhead is back to drawing board.

Small molecule competitor:

- Springbank Pharma

- Chromis Therapeutics

- Enyo Pharma

- RedXpharma

These companies each owns a specific asset, but does not really challenge Arbutus leader position. Springbank actually collaborates with Arbutus.

Partnership

Arbutus has research and collaboration with the Blumberg Institute. Partnering with the nation’s leading research organization dedicated to hepatitis B and liver cancer reflects Arbutus’ value.

Under this agreement, we have the right to obtain an exclusive, royalty bearing, worldwide license to any of the intellectual property generated through the research collaboration, on predetermined terms.

Able and trustworthy management

Arbutus has a strong management team. You can find their information on the company website management page.

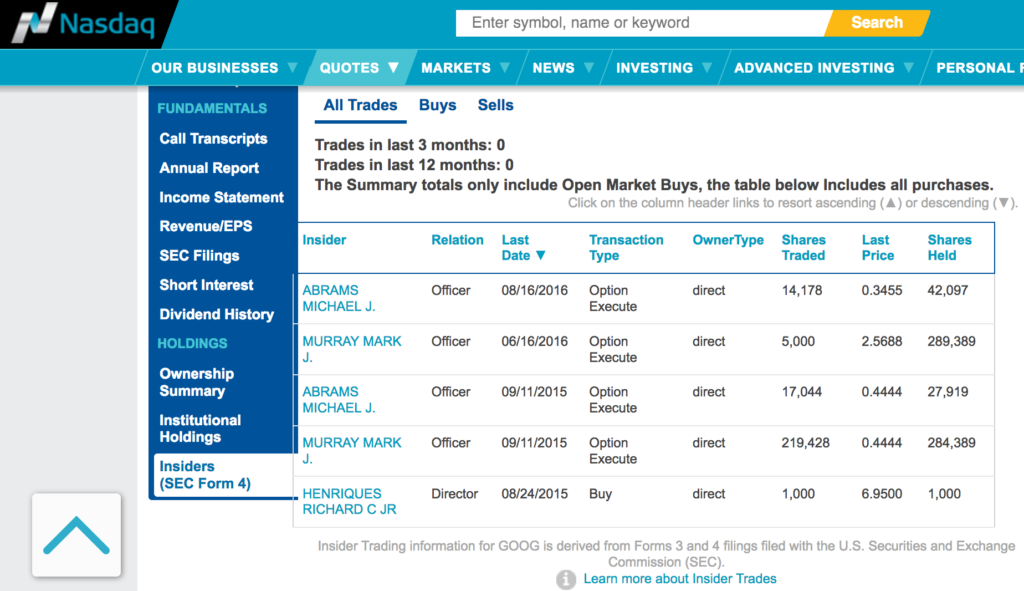

There is no insider selling activity:

Here I would like to emphasize on its Chief Scientific Officer - Dr. Michael J. Sofia.

Michael J. Sofia, PhD | CSO

Dr. Sofia invented the interferon-free regime HCV cure drug - Sofosbuvir, also known as Sovaldi. He won the 2016 Lasker Award with two other scientists for their contribution in “Hepatitis C replicon system and drug development”.

Here I quote below two interviews and one video of Dr. Sofia. Read and watch yourself. They convey very well what kind of personality he has. He speaks with modesty, integrity, and calmness with such great success and honor. His deep motivation in contributing to medical advancement and patient welfare cannot be more “trustworthy” than oath of any kind.

I asked Sofia what he’d be calling his next drug. “I consider myself very lucky to have one drug, he replied. “When I was doing undergraduate research at Cornell, I was told that I had to be comfortable with failure because eighty per cent of what you’re going to do is going to fail.” – The New Yorker, 2013 A Better Treatment for Hepatitis C

On winning the Lasker Award, Scientific American interviewed him:

Q: Finally, what advice might you give to young scientists today or those considering a career in science?

A: When I started my first undergrad research in a real lab at Cornell, I was working for a senior grad student, and he says to me “Mike, you know, I want to tell you this first: Eighty percent of what you do will fail. Twenty percent of what you do will succeed in research. If you are not happy with that 20 percent success rate, you don’t belong here.” It stuck with me forever because science is an endeavor where there is a tremendous amount of failure along the way. But the successes—especially in the field of medical research—are tremendously gratifying. You really do have the ability to impact people’s lives throughout the world, and there are very few endeavors I think that will afford you that opportunity.

– Scientific American, 2016 Inventor of Hepatitis C Cure Wins a Major Prize—and Turns to the Next Battle

Michael Sofia, Acceptance Speech, 2016 Lasker Awards

Bargain sensible price tag

- As of YE2016, Arbutus has 130M cash, about $2.4/share.

- At its speculative Ebola rise, Tekmira had all time high value of $31.48 per share. Now the bubble has been squeezed after Ebola disappointment, merger, discontinuation of 2 programs and delay of cccDNA sterilizer. It is now at 90% lower than all time high. There is little priced in at this level.

- Public offering: ABUS most recent public offering was at $20.25 on March 20, 2015. As a retail investor of small asset size, I prefer to buy below public offering price, since that’s the only way the big guys can invest big sum of money. Current price level of $3.3 represents 84% discount off the price paid by those institutional investors.

- Technical analysis: From multiyear low around new year 2017, ABUS has reversed its -90% downtrend and formed a round bottom below its 200MA. With the Alexion deal news, it broke out upwards with huge volume.

- Upside: if Arbutus delivers on its promise, on the conservative side, we roughly estimate it will worth half the Pharmasset’s 11.2B record, due to less patients in the lucrative US market and potential competition. On the optimistic side, we roughly estimate it will worth 1.5X Pharmasset due to HBV’s bigger global burden and higher interests driven by the successful sale of Pharmasset. Thus, for a market cap of 5.6 ~ 16.8B and estimated diluted shares of

65-70M (55M current shares)83.1M (10.2017 update after Roivant investment), ABUS would worth $67~202/share when buyout advents.

At this level ($3.3), ABUS presents ~27% downside risk to liquidation value and 24 ~ 78X 20 ~ 60X (10.2017 update after Roivant investment) upside potential in the coming years.

Conclusion

Arbutus is the leader in LNP technology and RNAi medicine. It is one of the front runners in the race to HBV cure. With a robust HBV pipeline and non-dilutive fund from LNP licensing, lead by industry veterans and award winning management team, Arbutus has better, if not the best, chance of reaching the finish line among its HBV peers. At this price level, $3.3/share, ABUS offers minimal downside risk for substantial gain in the coming years.