Investing: fairytale, drama and tragedy.

All the world's a stage, And all the men and women merely players. -- William Shakespeare

All the Wall Street is a stage, And all the managements and investors merely players.

Ideally, investing would be a fairy tale.

There is this idea and technology. It has the potential to make a better world. Investors provide capital, board of directors provide key guidance, management steer the ship and employees do the hard dirty work. Everyone on the same ship towards the same goal. There will be cruel monsters, deep rivers and high seas. But eventually they overtake obstacles and setbacks together and voila! Here is the new drug, solving an unmet medical need. Patients get a better life. Everyone is rewarded morally and financially. And lives happily ever after.

Realistically, investing is mostly a drama.

Management wants higher compensation, whose stock options often urges short term price pumps. Board of directors lack the motivation or power to control management. Investors also can be divided into existing and perspective investors. Existing investors prefer high price, and when company raise fund, it would love to sell at high price when everything looks optimistic to incur less dilution. Perspective investors want to buy low when the company is under stress, in order to get most shares with their money. Nonetheless, as long as the company and the investors have the same goal and persist along, usually it will eventually work out OK.

Unfortunately, more often, the investing drama does not fall into the genre of comedy, but tragedy instead. The sign of doom is heavy insider selling.

- Some insiders do this short-sighted.

- Fruition seems far far away. It may or may not work. Nobody can tell, even the insiders. Let's get rich first.

- Company can restructure when facing significant obstacles. Every technology go through its Gartner's cycle. CEO changes. Some CEOs don't necessarily believe their technology. Again, let's get rich first.

- Sometimes insiders have no shame. Management exercise option, VC unload can go to very large sum of money.

- Some companies and their insiders are completely fraud. They manipulate early stage trials and heavily promote "revolutionary" technology or product. But often they deliver complete failure in phase III, before which the management and VCs already sold their shares.

I found insider selling is particularly important for clinical stage companies. Insider holds non-public information about investigative drug candidates, in the mean time, they hold many shares as early founders and executives. They have the simplest motivation to sell into lack of confidence. While in big companies such as Illumina and others, selling shares is just a routine for employees to get extra money, much less to do with one or two product candidates.

We, as investors, need to identify such players on the stage of Wall Street. We want to play in the comedy, and stay in the audience watching the tragedies.

Here I present a few cases of insider selling victims.

Note: these opinions only reflect on insider selling. As company may change their strategy and management may leave and restructure, a former treacherous player may become a good citizen and investment candidate.

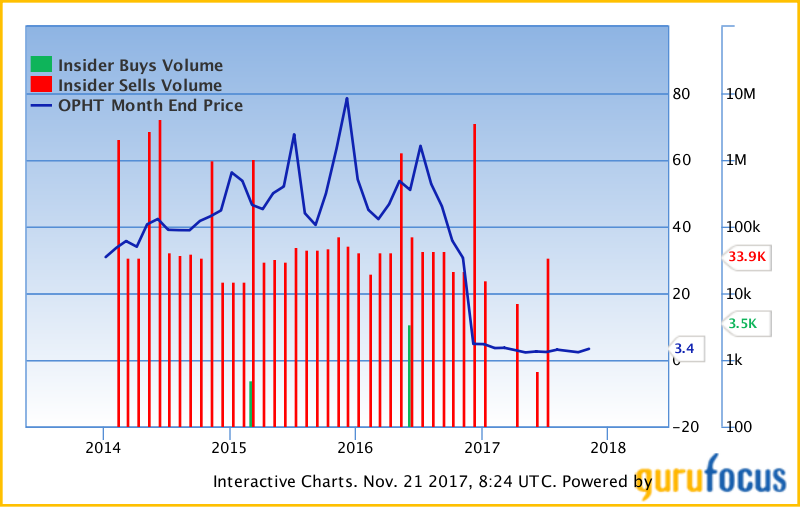

OPHT

Hype: Based on its phase II "success" on AMD by anti-PDGF aptamer Fovista (pegpleranib), OPHT made a successful IPO and subsequent $1B deal with Novartis. Price reached $80/share and market cap peaked at $2.8B for a phase II candidate.

Selling:

In 12 months prior to Phase III data release, there is massive insider selling at OPHT. The sellers include at least five directors/officers:

- David Guyer (CEO)

- Nicholas Galakatos (Director)

- Samir C Patel (President)

- Glenn P Sblendorio (CFO&COO)

- Barbara Wood (General counsel)

one major institutional holder: Novo Nordisk Holdings (probably a major early funder) cashed out $118mil since IPO.

Burst: On December 12th 2016, Ophthotech (Nasdaq: OPHT) released its much speculated Phase 3 trial results for its Fovista anti-PDGF therapy in combination with Lucentis anti-VEGF therapy in treating aging related wet AMD. Completely reversed phase II results and failure.

Aftermath: Novo Nordisk Holdings sold all remaining shares at $4.87/shr for $18 mil total . Stock price drifted towards $2/shr in 2017. Directors/officers continue selling shares well into 2017. Now the company has shifted its development focus to rare diseases.

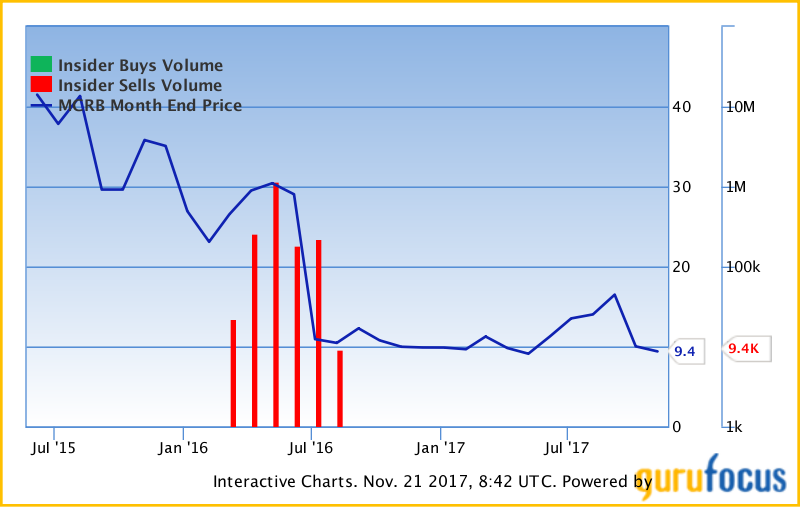

MCRB

Hype: so-called leader company of microbiome. To replace feces transplantation, MCRB propose to use standardized 50 species of purified spore of healthy gut bacteria to treat C. difficile. MCRB IPOed at lofty $52/shr and market cap $2B with a phase I product.

Selling: Insider selling began a few months after IPO (probably after locking period expired). Near 2 million shares were sold around $30/shr.

Burst: Phase II results released in July 2016 showed, MCRB's pure spores had no benefit to patients. Stock price crashed to $10. The timing of selling, right before failure, is amazing!

Aftermath: Insider selling stopped after the crash. Company argued that trial entry criteria was wrong and wrong patients were allowed in. It is also trying another condition - ulcerative colitis.

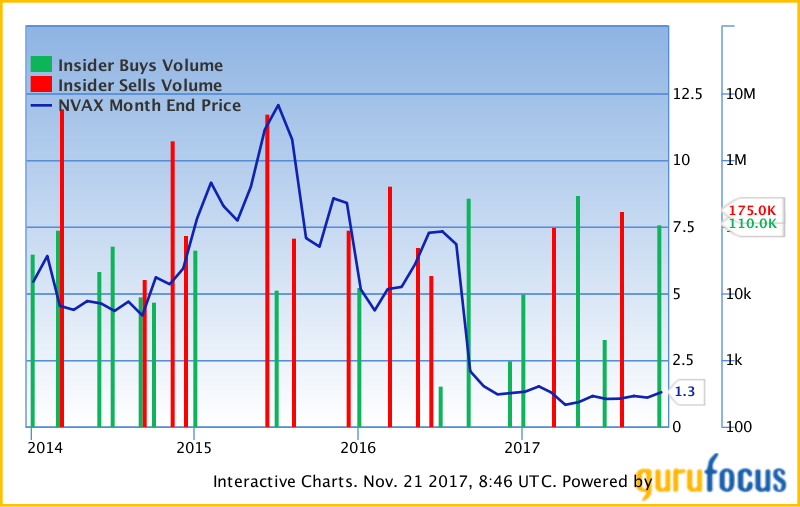

NVAX

Hype: Using nanoparticle vaccine (mimicking viral particles), NVAX aims to conquer RSV and flu. With its RSV phase III candidate and no approved product, NVAX reach a $4B market cap in the bullish summer of 2015 at $15 per share.

Selling: more than 13 mil shares were sold between 2014-2016 by insiders, netting about $100 mil cash for them.

Burst: in September 2016, phase III results showed no protection from NVAX's RSV vaccine. Stock price cashed from $8.34 to just $1.40 in a few short hours.

Aftermath: unable to raise money, the company borrowed $300 mil debt to fund R&D.

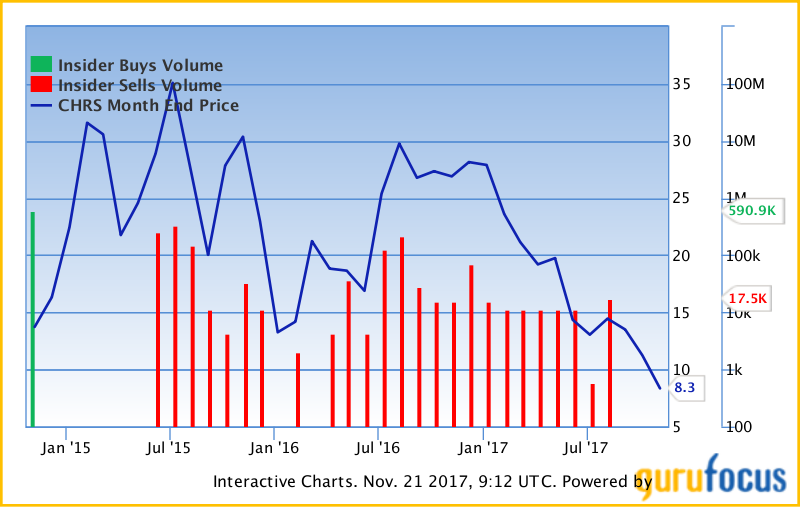

CHRS

Hype: The pure play biosimilar company, Coherus developed biosimilar to almost every one of those best-selling proteins and antibodies, from Neulasta to Humira and Enbrel. Market cap reached about $1.5B

Selling: Soon after IPO lockup expiration, insiders started constant selling. More than 1 million shares (~$30/share) were sold from 2015-2017 prior to 2017 June PDUFA date for Neulasta biosimilar.

Burst: FDA issued CRL and stock price crashed to $8 (as of 11.21.2017). Many patent disputes failure news came.

Aftermath: Insider selling stopped after CRL (perfect timing). As the company struggles to win FDA approval, patents and lawsuits disputes. We shall wait to see its down trend bottoms and reverse.

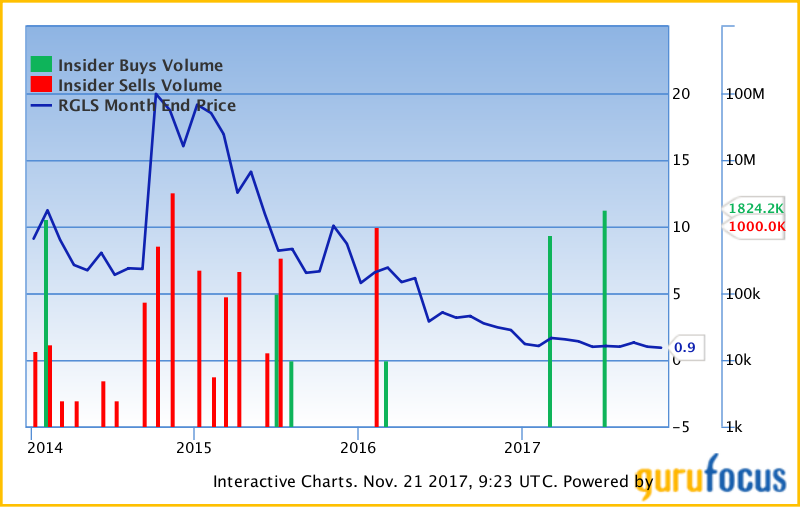

RGLS

Hype: I personally like this company as of 2017, but from 2014-2016, it was a huge hype and selling fraud. In October 2014, the company announced clinical results showing RG-101 can reduce HCV viral load after a single dose. Price shoot up from $6 to $25.6. Market cap reaching $1.3B. It seemed a better HCV drug is on the horizon.

Selling: Public offering and insider selling soon followed. More than 5mil shares were sold from 2014 to 2016 above $15 per share. Then CEO sold all his millions of shares before announcing unexpected departure from the company.

Burst: Sovaldi took HCV market by storm, taking $20B+ yearly sales, single-handedly cured HCV epidemic. RG-101 struggled in trials, was eventually halted and discontinued in 2017. Other candidates also failed expectation.

Aftermath: Regulus underwent management restructuring and strategic changes in R&D, in 2017. Now trading at less than $1. It lost 95% of its peak value in 2015. Insider selling has turned into insider buying. Chairman just bought 1 mil shares. As the miRNA medicine leader, let's wait to see RGLS come back strong.

ONCE

"AXON is another example of a company turning their experience and your money into their money and your experience"