This post was originally written for and published at BC-LA blog.

By Yi Liu, PhD ([email protected])

Yi is a project scientist at UCLA, biotech blogger at bioequity.org and associate at BCLA.

Biotech Industry of Orange County - Part II

This is the second part of Orange County biotechnology companies. I cover the smaller 7 of 14 biotechnology companies in Orange county. For the previous post on larger 7, please follow this link

| Ticker | Name | Market Cap (M) | Employees No. | Product & Service | City | Zipcode |

|---|---|---|---|---|---|---|

| ELGX | Endologix | 214 | 675 | Aortic stent | IRVINE | 92618 OC |

| NVUS | Novus Therapeutics | 45 | 8 | Middle ear diseases | IRVINE | 92612 OC |

| BIOL | BIOLASE | 33 | 195 | Dental lasers & scanners | IRVINE | 92618 OC |

| BMRA | BIOMERICA | 32 | 39 | Diagnostic tests | IRVINE | 92614 OC |

| PDEX | Pro-Dex | 31 | 67 | Surgical tools contract manufacturer | IRVINE | 92614 OC |

| HJLI | Hancock Jaffe Laboratories | 27 | 9 | Heart valve, bypass graft | IRVINE | 92618 OC |

| RSLS | ReShape LifeSciences | 356K | 83 | minimally invasive devices for obesity | SAN CLEMENTE | 92673 OC |

Data as of 08.2018

Endologix

Endologix makes aortic stent system for patients with abdominal aortic aneurysm (AAA). AAA is a very competitive space with a couple of other players including medical device giant Medtronic. It was founded in 1992, went public in 1996. It had its first FDA approval in 2004 with the powerlink system. It acquired competitor Nellix and its Nellix system in 2010. It merged with a competitor TriVascular in 2015 and gained another product - Ovation system.

Despite 15 years of corporate history with approved products, business has been very challenging for Endologix. During the entire 27 years of corporate history, Endologix bearly had a year with profit. It often have to depend on issuing stocks to stay afloat. More than half of its operating expenses are spent on marketing and sales, which is 4 times than its R&D expenses. It suggests the company relies heavily on marketing.

According to experts, Endologix’s current (approved in 2011) AFX aortic stent graft system differs from the other approved endovascular aneurysm repair (EVAR) systems in several ways. It features the only unibody main body component, in contrast to the usual two- or three-component modular design.

Unfortunately, AFX system suffered a “FDA Class I Recall” - the most serious type of recall - in July 2018, due to risk of type III endoleaks. A year before that, revenue growth was already losing steam as safety cases concerned physicians and surgeons. After that recall, revenue decline started to accelerate.

Right now the company is trying to bring two systems - Ovation Alto and Nellix ChEVAS - to the market. In the meantime, the new CEO is emphasizing cost cutting and improving internal accountability. Hopefully that will bring Endologix back to growth.

Novus Therapeutics

Novus was created in 2017 when Otic Pharma reverse merged with then-stressed Tokai Pharmaceuticals after Tokai’s Phase III prostate cancer drug candidate galeterone failed in 2016. Like its predecessor Otic, the new company Novus focuses on the development of ear, nose, and throat (ENT) products.

Its current lead candidate is OP0201. It is developed as a potential first-in-class treatment option for otitis media (OM). OM is often caused by Eustachian tube dysfunction (ETD). Although OM is a common disease, there is no approved drug for OM. Pain killers are used to manage the pain; while antibiotics are frequently prescribed (over-prescribed) despite its limited efficacy. Ventilation tube on eardrum to external ear canal has now become standard of care.

OP0201 uses Novus’ surfactant platform. OP0201 is a noval device-drug combination of a surfactant (dipalmitoylphosphatidylcholine [DPPC]) and a spreading agent (cholesteryl palmitate [CP]) suspended in a propellant. OP0201 aims to absorb mucosa, reduce surface tension of the Eustachian tube, open it up so that the ventilation of middle ear is restored. OP0201 is currently in Phase 2 development for Acute Otitis Media, and Phase 1 for Chronic Otitis Media with Effusion.

Novus had another program – foam platform – OP01XX for Acute Otitis Externa. Although OP0101 proved to be effective in treating AOE infection, the product is not sufficiently differentiated from other products in the market. Although it developed a second generation candidate OP0102 with more rapid pain relief and infection clearance, it suspended the program to focus resources on OM surfactant program.

Since it released OP0201 phase I trials safety data in April, NVUS has lost more than 80% share price. As of 2Q2019, Novus has 13.7M cash in hand with a 4~5M cash burn per quarter. It probably needs to raise cash again soon, even though it already did a 10.7M direct offering in May 2019. At current price level (0.69/share as of 08/27/2019), it will cost NVUS lots of shares to raise some fund.

BIOLASE

BIOLASE is a medical device company focused on dental laser systems. It sells dental laser systems for all-tissue cutting (including bones) or soft-tissue cutting. When approved by FDA in 2002, BIOLASE’s WaterLase system was the first-ever clearance from the FDA for laser cutting, shaving, contouring and resection of oral osseous tissues (bone).

While BIOLASE is the leading provider in both all-tissue laser and diode soft-tissue laser, laser systems (all-tissue laser) only penetrate 7% dental business in the US and 1.4% worldwide. This low penetration could mean potential market expansion, but also highlights the low acceptance among dental businesses.

According to data from GuruFocus.com, BIOLASE enjoyed a steady revenue growth till 2008, and sharp decline since then. Its revenue never really covered its Selling & General Administration costs. It lost money almost every year since 1992 except for returning a brief profit in 2004.

Recently the company has discontinued intraoral imaging business, which was selling at a loss. It decided to focus on pushing the market penetration of its WaterLase dental laser systems while implementing cost cutting measures. Long term survival of BIOLASE will be determined by whether the management can turn in a profit sustainably.

BIOMERICA

Biomerica is a medical diagnostic company. The Company’s test kits and devices are sold in three markets:

- Clinical laboratories

- Physician’s offices

- Over-the-counter (pharmacies)

Biomerica’s revenue has been in decline in recent years and also losing money. To bring the business back to profit, the company is developing a test kit called “InFood IBS”. It is designed to help IBS patients identify foods that can alleviate IBS symptoms. IBS is a huge market and any small benefit to patients may translate into commercial success. Biomerica needs to show clear efficacy and convince users to buy InFoods IBS to test their foods.

Biomerica is also developing a colonrectral cancer test and an H. Pylori test.

Pro-Dex

Pro-Dex is an OEM high precision cross-industry contract manufacturer. It has mainly collaborated with several of the world’s largest providers of medical and dental products. It is expanding into other industries.

Hancock Jaffe Laboratories

Hancock Jaffe Laboratories (Hancock) was founded in 1999. It was co-founded by Norman Jaffe, Ph.D., one of the most influential experts in the field of bioprosthetic devices. He passed away in 2016. The company has a small 3-people board of directors. Besides CEO, the other two directors are both veterans of cardiovascular bioprosthetic device industry.

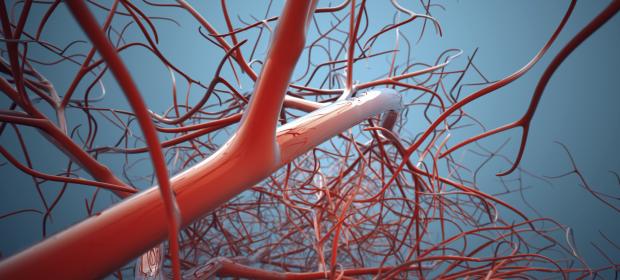

Hancock follows the strength of Orange County in cardiovascular medical devices (Edwards, Endologix, etc.). Since 2007, the company has focused on developing “heart valve replacement and coronary artery bypass grafting — and the universally acknowledged most debilitating vascular disease of the lower limb — deep vein insufficiency.”

Hancock is testing two products:

VenoValve for Lower Limb Chronic Deep Vein Insufficiency (DVI), which affects 2.4M people in the US and has no treatment options. DVI is due to the failure of damaged venous valves. VenoValve is a venous device to replace damaged one. In June 2019, it released initial first-in-human studies results.

Coronary Artery Bypass Graft (CABG): CABG, colloquially heart bypass or bypass surgery is a well known procedure to save heart from failing. There are 200,000 surgeries per year in the US. All CABG grafts are harvested from patients themselves. Such harvesting is painful and invasive. Complications at harvest sites are common. Not all patients have enough accessible veins for harvesting. Hancock is developing a bovine based off-the-shelf conduit to serve this unmet medical need.

The company touts it aims to be acquired by bigger medical device companies sooner or later.

ReShape Lifesciences

ReShape is a penny stock company ($0.07 per share as of 8.27.2019) now trading on OTCBB market. It markets two obesity and weight loss products: Lap Band and ReShape Vest.

Its business has gone through roller coaster in 2018:

- reported poor sales in April 2018, lost 57% share price that week and continued diving from then on.

- 1-15 reverse split in June 2018

- 1-140 reverse split in Nov 2018

Summary

Orange county is a strong hold of medical device industry. This is reflected in both bigger or smaller ones of biotechnology companies.

The Orange County biotechnology companies series is now complete.