Events at the time of writing

05/04/2014 $71.46

04/21/2014 NDA submitted for Ceftolozane/tazobactam

03/31/2014 Cubist received FDA Advisory Committee 14-0 vote for Sivextro (Tedizolid)

Philosophy and Execution

When I discovered this company in a CAN-SLIM screening in early 2013, I was immediately attracted to its vision:

Cubist Pharmaceuticals, Inc. is a biopharmaceutical company focused on the research, development, and commercialization of pharmaceutical products that address unmet medical needs in the acute care environment.

As civilization progresses, in many business field, the world has become more and more specialized and focused. Southwest focuses on one type of aircraft, 737; Foundries specialize in chip manufacturing for specialized chip designers; Tesla thrives to deliver one car at a time. This is also true in the biotech world. Old big pharms are falling (or failing?) behind biotechs in innovation. The success of Gilead highlights their absolute focus on nucleotide analog for viral diseases.

Saving any more philosophical discussion, Cubist is a niche company who knows crystal clear what it want to do. Besides that, it also has good track record at execution, with its faithful product deliveries and strategic acquisitions. As antibiotic abuse makes multidrug resistant bacteria more and more common in USA and around the world, Cubist has the potential to save the world, and make some money along the way.

Products and pipeline

Currently, majority of revenue comes from Cubicin. Dificid and Entereg recently joined its portfolio after acquisition deals. The company is trying to re-market them. There are also promising candidates in the pipeline: Tedizolid is likely to be approved; Ceftolozane/tazobactam NDA is just submitted; four more new indications (including two more new drugs) are in phase 3 trial.

Margin and Profit

However, as technically promising as Cubist is, Cubist may not be a great company for investment. Antibiotic field is getting crowded again. With the incentives from GAIN act, big companies are coming back, and small companies are already competing in this once-ignored field. Some main competitor drug (such as linezolid) is becoming generic, and in the meantime, Cubist's own products may also suffer from the doom of resistance. In addition, its heavy commitment in R&D won't see a relief in the near future.

All the factors above give Cubist a below industry-average net profit margin. Its best record was ~16% in 2012 and it even lost money in 2013 due to aggressive acquisitions.

Our PSIC club has made our assumptions and valuated Cubist. We conclude (as of 04.2014):

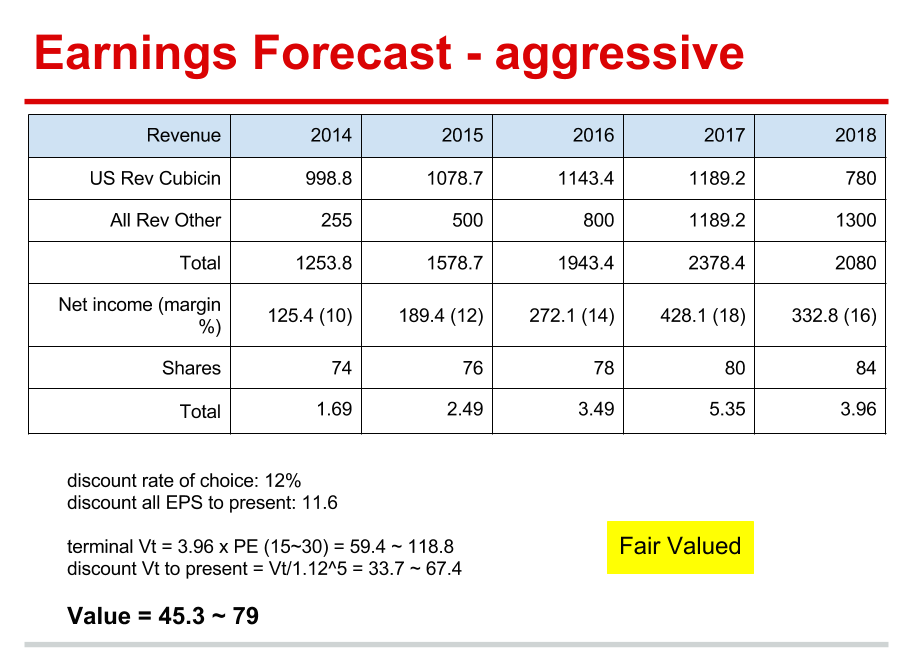

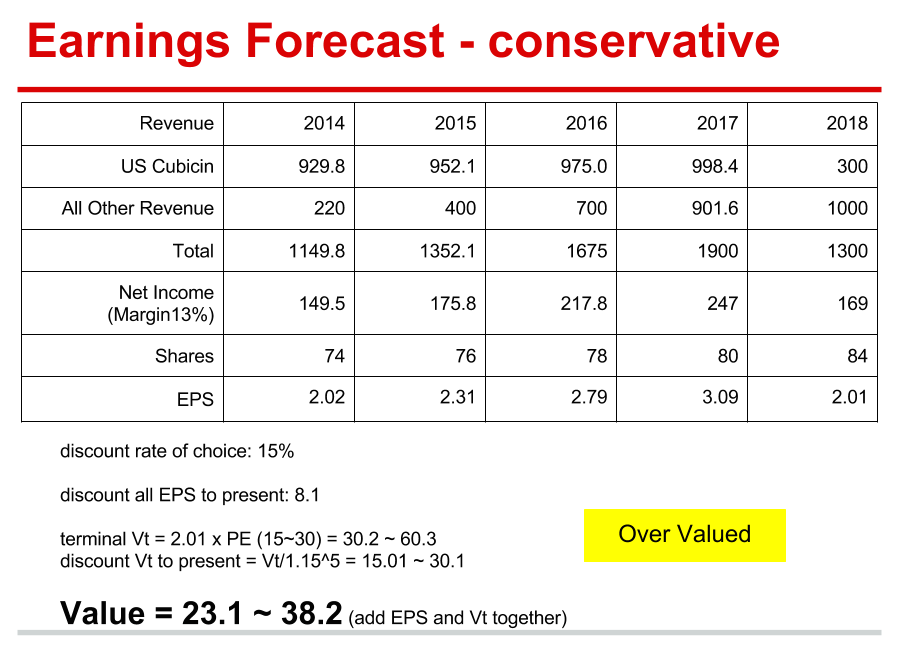

CBST's fair value is about $23.1 - $38.2 (conservative case) or $45.3 - $79 (aggressive case).

Please refer to the slides attached at the end of post for some details of our assumption:

When CBST proves itself

Cubist is a great niche company, as it is loved by investors showing in its high multiples. For the sake of investment, it is at most fair valued now for a decent return. If one demand a superior return from CBST, one should wait for a lower price tag. Or, CBST could prove itself by crashing our estimates of revenue and profit margin. That could come in many ways:

- Delivery of great products.

- Efficient cost control (esp. R&D)

- Good sales either by marketing or from rise of MRSA.